Frequently Asked Questions About Public Adjusters, Damage Appraisers And Potential Claims We Can Help Resolve Successfully

Below are some of the questions commonly asked by customers and prospects alike. Answers and additional explanations have been provided. For those who still may have additional questions, simply call us at (774) 239-0652 or email us or use our contact form to ask your questions. A staff member shall respond to you promptly.

About Fire Insurance Claims

Are you thinking of hiring a public adjuster? Perhaps, you are looking for some information about them and how they can solve your fire insurance claim. Stay tuned here, because we have all of information you need. The answers to your questions are at the tips of your fingertips now.

Adjusters are part of the insurance claim industry. These public servants conduct private services with policyholders when their client has experienced a fire or other calamity related incident. They represent their client and negotiate on their behalf.

When the unexpected happens — fire, specifically — your home insurance is there to help you out. Policies with fire damage coverage will help with the repair of your house. Additionally, it will cover your relocation and living expenses, depending on your situation.

Right after a fire, your goal would be to find your copy of your insurance policy. Read it again so you know how you will handle your fire insurance claim. If it was destroyed by the fire, contact the insurance company. Report your loss immediately and request a copy of your policy. It’s advisable to obtain the services of an independent public adjuster from the start. This will help you to avoid any potential errors that could cost you money.

Prepare yourself before you even face an insurance company adjuster. Remember, their priorities include preventing insurance fraud and settling low-amount claims.

Make sure you are not lying or hiding information. Don’t agree with the first offer; it’s usually low. Keep the conversation short. As they say, “less talk, less mistakes.” Don’t sign anything immediately. If you have a public claims adjuster to negotiate for you, that would be better. You will quickly learn what to say and what not to say.

Insurance companies find reasons to reject fire claims. The most common reasons for denial of insurance coverage are inadequate coverage, lack of evidence, defective smoke alarms, and missed premiums.

If your fire claim is denied and you do not agree with it, file a dispute. You can ask for the help of a public adjuster to review your case. They may ask for more proof such as photos, videos, receipts, and others so that they can re-examine your claim fully.

To be able to receive the highest possible amount for your fire insurance claim, make an inventory of the items damaged by fire. Monitor the expenses you incurred during your inventory, as well as the cleanup and repairs. Keep receipts, take photos, and write detailed descriptions. Record all communications. If possible, request the insurance adjuster to write whatever has been discussed so you have proof. More importantly, get help from a public claims adjuster because they will help you get the most out of your fire insurance claim.

You may be thinking, ‘Why should I get a public insurance claims adjuster when my copy of the policy can already work for me when I file my fire claim?’

Yes, that’s true. Your insurance policy says it all. It states everything that’s covered by your insurance company. However, it’s not always easy to deal with an insurance adjuster — the one that would handle your fire claim. Remember that they are working for the insurance company and not for you.

If the insurance adjuster is making the process difficult for you, then it is best to hire a public adjuster. More importantly, if they are making all efforts to give you a lower amount than what you are expecting, hiring a public adjuster will work for you.

To put it simply, insurance adjusters perform their duties to their employers while public adjusters do theirs for the benefit of homeowners like you. They are the ones that meet with the insurance company adjusters to negotiate from the start to end of the fire insurance claim.

Say you are always in disagreement with your insurance adjuster. Should you just agree with the settlement? No. Write them a letter confirming their refusal to cooperate or to even hear you out. Have this included in your fire insurance claims. This is another instance when getting a public insurance claims adjuster becomes helpful.

Your house is damaged by fire. While you already file your fire insurance claim, it will take a longer time before you receive it. What you need to do is request an advance or initial payment. You can use this so you can start the cleanup and repairs or find a temporary shelter.

Review your policy to know if your claim will be covered. You may consult with a public adjuster. They will help you understand your fire insurance coverage and how it applies to your actual fire claim.

Typically, home insurance fire coverage includes:

• Home structure and materials – If your fire claim is valid, you can get the insurance company to pay for the repair costs of your home.

• Content – If the things inside your house are destroyed by fire, the insurer will shoulder the costs to replace them.

• Loss of use – If your home is no longer habitable, your insurance claim will also include additional living expenses like food, short-term rental expenses, and others.

• Personal liability – If your neighbors’ houses were also destroyed by a fire that started in your house, this type of coverage will at least lighten your burden in paying for settlement and legal expenses, but check your policy if this is included.

Again, review your policy to know what is not covered under your fire insurance. This is because not all types of fire damage is covered. For instance, if the insurer found out that negligence or arson was the reason for the house fire, don’t expect a successful fire insurance claim. The same is true with fire damage caused by acts of war.

Say you disagree with the first offer. For you, the amount is not enough to cover everything you have lost and everything you need to do to live again in your home. What you do is to talk to the insurance adjuster. As much as you can, be polite and stay calm. Never fall for their tactics. Ask questions. Present the facts. Also, submit a letter and explain why you do not agree with the settlement amount. Better yet, look for a public claims adjuster to represent you.

Yes, your insurance covers accidental fires. What is not covered is when it is determined that you purposely set the fire. This makes it ‘not accidental’.

Accidental fires at home are commonly caused by:

1. Cooking and cooking appliances;

2. Smoking; and

3. Electrical equipment

Your neighbor’s negligence caused the fire that unfortunately damaged your home. It is not your insurance company that’s responsible. It would be your neighbor and their insurer.

Talk to your neighbor and check if their policy covers the damages to your home. However, you have to prove that it’s your neighbor’s fault so you can successfully file a fire claim.

Your insurer has already given you your insurance check. You can use the money to do all the repairs necessary and replace all the things you’ve lost. For as long as your policy as well as the state laws allow it, you can keep the money so you can use it for other purposes.

When you receive help from a public adjuster, you give yourself a little peace of mind—no need to think much about the things related to your incident. The professional will lend you a hand. What can they do?

There are different types of fire accidents. They can happen anytime and anywhere. They need to be documented well so that your insurance company can cover it. Public Adjusters can help you along by proving these documents to the insurance company involved.

In a time of loss, you may still be confused about many things. You may overlook things that need critical attention so you can claim your insurance. Do not fall behind. Focus your mind on other necessities and let a public adjuster do the work for you.

It is common for insurance companies to do their assessments after a fire incident. With this, you might be at disadvantage because the assessment will be biased towards the insurance company.

The Public Adjuster will see more in your best interest. They will always be on your side. Accordingly, they will help you prove to the insurance company that you need a maximum claim amount. You will then get much more than you normally would have without a Public Adjuster.

Fire claims can last for 90 -120 days. They start from the day of loss. You need to make sure that everything was passed without any problems. It will help the process go smoothly. Make sure you know the actual procedure so you do not have any unexpected hurdles and delays.

If you are thinking about talking to the insurance company alone, make sure to read this part first.

Lack of claim experience is a considerable disadvantage. You most likely do not have the necessary knowledge to do things correctly. Yes, there is a step by step process and others can help you, but there is still the chance that you will miss some things.

Lost time and money may be the consequences of illogical actions towards fire claims. Do not waste either of the two. You have experienced enough already. Make the right decision today.

You will need to wait for everything to be finished until you can go back home. Your safety is our first concern, so do not decide to go back home without full repairs. Wait for your insurance company to give you the green light before doing it.

About Earthquake Claims

An earthquake claim is a type of insurance claim that covers your home under certain policies. It can help you if you are subject to an earthquake. It usually covers the following:

● Repairs of your home, such as condo units or residential houses.

● Replacements and repairs of damaged belongings inside the house.

● The cost of the place you need to stay at while your house is under renovation.

Yes, it covers both. However, you need to purchase different types of insurance for each. Living in a high-risk area can be devastating, and investing in insurance will help if a disaster strikes.

When you reside in a high-risk area, it will indeed be worth the investment. It helps with many things, such as covering the cost of living while your place is under repair, the replacements for damaged belongings and ultimately makes everything easier.

Insurance has become popular over the years. You can find many affordable prices offered by insurance companies. Some factors will affect the specifics of the insurance, like the location and features of your home.

One of the most considerable assets you own is your home. If you do not get insurance, you will be alone facing a significant financial issue. You will have no one to cover the expenses you need to repair your home.

You can contact your nearest insurance company and ask them about earthquake insurance. They will gladly help you and discuss the things necessary for obtaining this type of insurance.

When you hire a public adjuster, things will be much easier for you if you undergo the stress of lost belongings due to an earthquake. Public adjusters can help you prepare, file, adjust and claim your insurances. They work for a different company, not for the insurance company itself

No, they are not. You can employ a public adjuster yourself, not through the insurance company. However, many public adjusters also known as staff-adjusters are employees of an insurance company. An independent public adjuster will help you understand your insurance company and guide you through how the claim works.

Sometimes it is difficult to understand everything about getting insurance from an insurance company. Public adjusters will explain the policies and coverage of your insurance without giving you any burden. They are very professional and highly experienced in this field.

Yes. Public adjusters of 111 Construction Services LLC are trained to understand the claim of their employer thoroughly. When they prepare the claim, you will likely get it sooner. They have plenty of knowledge and skill to serve you when it comes to earthquake claims.

Public adjusters will charge you a percentage of your claim. However, the payment is only made after the claim is settled, not before deciding to hire them. They will take all of the efforts necessary to help you avoid stress when claiming your earthquake insurance.

About Fire and Smoke Claims

Have you recently been subject to a fire and smoke incident? Do not do anything impulsive by claiming your insurance yourself. There are professionals who can do this on your behalf. They are called public adjusters.

For more details about public adjusters and fire-smoke claims, make sure to read everything in this article. Let us help you make the most of your insurance policy.

Public Adjusters are essentially professional liaison agents between a policyholder and an insurance company. They serve as investigators who, after collecting evidence, help their clients on their insurance claims. In short, they ensure all negotiations and settlements go seamlessly and positively for their clients.

After a fire and smoke incident, you will need to secure pieces of evidence to validate your insurance claim. This is the first job of a public adjuster. They must aid you in securing documents so that you can have better chances of getting a generous claim.

The professional will later continue the procedure of the fire and smoke insurance claim for you. You do not need to worry about it anymore, and you can then concentrate on the welfare of your home.

When calamities happen, insurance claims are expected. Private individuals can do it, but most of the time, they get a representative to do it a lot better for them. A public adjuster is the representative in this case. And the great thing is that they provide this service on a best effort basis. That means if they’re not successful, you don’t pay anything. They are indirectly paid by your insurance via your claims.

Public adjusters are professional individuals who negotiate for an affected individual after an accident. If you are hiring a public adjuster, make sure to check their license. There are a lot of people claiming to be in this kind of work. Do not get scammed.

Additionally, be quick to ask about their intentions. Do not be impulsive when they talk about how they can help you out. Yes, they can indeed, but there will be a process for it. Make sure that you will get everything out of using this service. You will spend a little bit on their service, but there are so many advantages you get as well – the cost is well worth it.

Nothing is illegal about hiring help when it comes to insurance claims. As long as you follow the right process, everything will be okay. It is within your legal rights to get a representative at your discretion.

Anyone who has experienced an accident can hire a public adjuster. It is a person’s choice, and no one can stop you. The insurance company cannot drop you. If it does happen, you can file a report about them.

Yes, you can go back to the house to survey the damage. However, it is not advisable to stay there if the damage is large. It would be dangerous because the fire, smoke, water, and other elements could have brought more damage to the property.

It is better to wait for the insurance company to proceed with your repair first. After everything is fixed, you can go back home.

For the same reason above, you cannot do the cleaning because it could pose dangers. Leave everything to a professional, so nothing critical can happen.

Proof of ownership is the most crucial evidence. You will need it to expedite your insurance process. In this way, no further questions will be raised about your authority over the house.

It is also best if you have the insurance policy reviewed along with your public adjuster. Through this, you will know what else the insurance company requires for claims.

When a fire breaks out, it will not only damage, but it will disintegrate. The smoke and other elements add more damage. It is best to call a public adjuster early on to help out in assessing the damage for your insurance claim.

A public adjuster is a professional individual trained to handle insurance claims, and part of that is determining an estimation for insurance return. They will also be aided by a team to provide a better assessment. There will be house visits, computer programs, and other methods used to assess the damage and follow through with the claim.

The public adjuster will work on your paper for 90-120 days from the day of the accident report. If you want to fast track it, you need to do follow the correct steps. Follow the policies to make sure everything is smooth. Do not leave holes and space for delays.

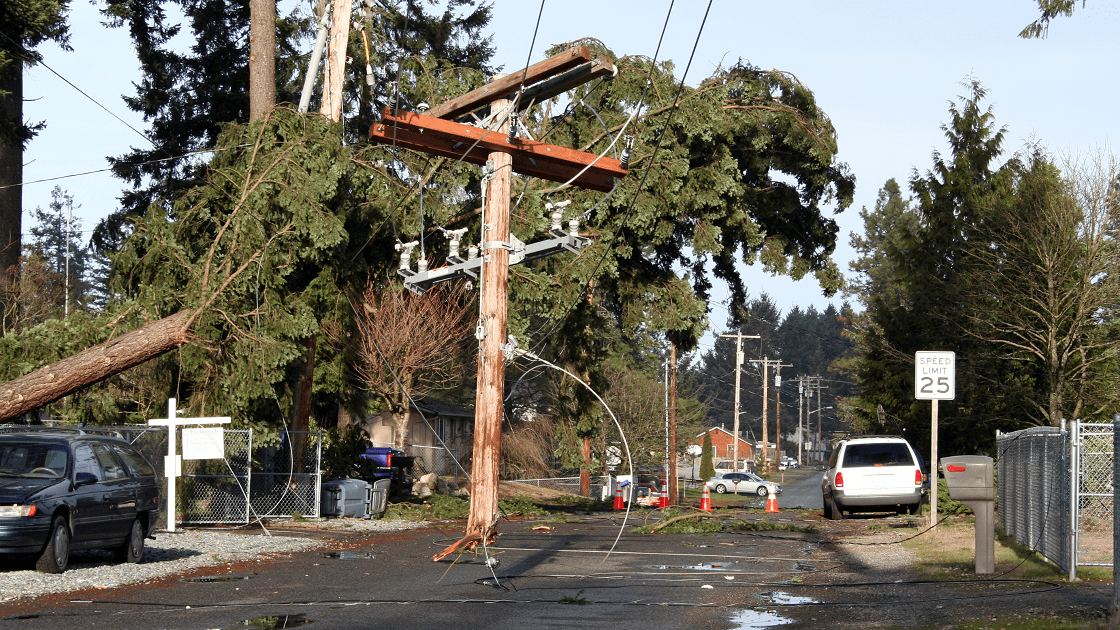

About Hail and Storm Claims

Hail damage affects millions of people across the globe every year. This loss could cost property owners thousands of dollars, as hail storms can considerably damage buildings and cars. The most common insurance plans should cover hail damage.

Are you having doubts about something related to insurance claims? We’ll answer it for you! If you do not see your question here, you can contact us directly.

Between roofs, vehicles and more, repair time varies, based on the intensity of a storm and the impact. Reparations can take 2-3 weeks for light to moderate damages, but severe damages require the body shop’s involvement for panel replacing and painting operations.

Damage to Houses or Buildings can include:

● Holes on a metal roof

● Broken windows

● Broken siding and leaks

● Missing or cracked shingles

● Broken chimneys and flue vents

● Peeling paint

● Broken air conditioners

● Broken and decaying wood

And Damage to Cars can include:

● Broken windows

● Scratches in the body of the car

● Damaged engine

● Cracked windshield

Yes. If the storm hits your area and your neighbor’s roof has been fixed or replaced, you may also get storm damage coverage. It’s always better to have damage checked.

If your home is destroyed, the insurance provider can pay for your temporary relocation costs up to reasonable limits.

The response to this question is “yes.” No matter the age of the issue, you can get your roof repaired at any time. There is a risk that your whole roofing system will undoubtedly have to be modified.

You will have to repair this – even if you have just a small amount of damage – to protect your roofing system’s structural integrity. To avoid repairing minor damage may result in more expensive damages, such as water damage.

If the claim is backed by the fact that the house’s roof was destroyed by the storm’s direct cause, your claim will be paid because you have storm-related insurance for your property.

If your home has damage, call an insurance provider. An adapter will come to your home and assess the damage as soon as possible. Remember, somebody may not be able to come instantly in a crisis. Be calm.

Your payout period varies by an insurance provider, but, for the most part, the time limit for claim filing is 12 to 24 months from the disaster. To see how long you have to make a claim, contact your insurance company or a licensed agent.

It usually depends on your insurance policy. Some homeowner’s policy covers disasters, including damage from hail, wind, and other storms. However, earthquakes and floods typically require further coverage. For the precise range, reviewing your insurance policy is always a wise move.

National Damage Appraisers can help if your property was destroyed by hail and your insurance provider refused your claim. Our team of lawyers consists of specialists in insurance law. For a free consultation, please contact us as soon as possible. If your case does not succeed, you won’t pay a penny.

About Hurricane Damage Claims

Hurricane damage refers to the destruction of properties such as homes, businesses, or equipment due to very strong winds from a hurricane. This damage can instigate several other property destructions such as leaks due to roof damage.

Lack of preparation in incidents such as these can leave a big dent in your savings, which is why you should prioritize filing insurance. Knowing that you have insurance to rely on can help you focus on things that matter more.

1. Roof damage from winds, strong gusts, and rain

2. Interior home damage brought on by roof damage, leaks, mold, and debris

3. Electronic malfunction after a storm

4. Utility damage to power cable lines from water

In order to obtain hurricane damage insurance, one must file for several insurance policies. Your insurance coverage can range from debris removal to property replacement from the homeowners’ insurance policy. However, it is not the only policy you will need for a hurricane incident.

Property damage brought about by storm water and windstorms may be excluded from your coverage. Auto insurance can also be added if you’re concerned about your vehicle. Read about the extent of your insurance coverage to spare yourself from future complications.

You should file a claim immediately in order to start repairs on your property. This will prevent people from getting hurt, as well as stop further damage. Molds and property deformation can occur if the property damages are left untreated, and this may lessen the compensation that you receive from the claim.

1. Take pictures and videos of the hurricane damage on your property.

2. Make a list of the damages.

3. Contact us immediately at 111 Construction Services LLC to assist you with the filing of documents and to know which documents you should prepare.

4. Do not get rid of damaged properties, but carry out repair measures promptly.

Handling negotiations with insurance agencies can be complicated. There are lots of scenarios where your claim can be downplayed or estimated below its actual value. Having a public adjuster assist you can help you resolve claims faster, and always within your best interest.

A public adjuster can properly assess your property damage for you, closest to the actual value of damages. Public adjusters are experienced in carrying out successful hurricane claims. We are well-equipped to help you with filing claims and guiding you through what to include or exclude to get the biggest benefit out of your claim

Public adjusters can maximize the benefits you receive for your hurricane damage claims. Our company has a lot of experience and a clear understanding of insurance policies. We are well-equipped to assess your properties and negotiate better claims for you.

Our team is composed of board-certified damage appraiser experts at 111 Construction Services LLC. We use our years of experience to make sure our customers receive the maximum benefit for their claims, along with the latest technology to assess damages properly.

About Natural Disaster Claims

Have you ever thought about what you would do if you had a natural disaster strike your home? How can you accept insurance policy payments within the policy you are under? What are the benefits? What is the process?

Below, you’ll find answers to your questions.

You have to report your situation at the earliest opportunity. It might take much longer to get an adjuster to you if there are several earthquakes a year or severe storms. Insurers commonly prioritize frequency claims.

You want to act immediately after a natural catastrophe. Essential steps are detailed here:

● Take photos of the situation.

● Make repairs in an emergency.

● Talk to your insurance provider.

● Know what your policy includes.

● Fix your property with the contractors you employ.

A disaster management team member can contact you to decide whether you need a damage assessment or whether a phone call can handle a loss.

An appointment is required to book as early as possible when an inspection is necessary, but we typically make appointments for clients with the most extensive damages first.

Let’s assume you are dealing with your personal property during a disaster, and the policy requires personal property expenses other than insured losses.

In that case, a detailed explanation of personal property damages is needed for the team manager’s disaster claims, such as the manufacturer’s names, model numbers, delivery dates, and the selling price.

For most people, rebuilding/repairing/replacing homes and property after a significant loss takes 18-24 months.

If you have adequate coverage on your auto insurance policy, it can help pay for fixing or replacing your vehicle after a flood. To file a claim, consult your auto insurer.

In general, insurance costs are only compensated if the property is impaired—the reason is that the coverage belongs to the land policy only.

Many insurance firms have the credibility that they treat claims fairer and quicker than the others. Choose 111 Construction Services LLC and learn your rights by maintaining an insurance plan and showing that the benefits are valuable to helping you reach a reasonable agreement with any insurance provider.

Preparing your life ahead and thinking about what to do after a tragedy, rather than panicking, is a smart thing to do. If you do not see your questions here, please contact us at 877-290-2929 for any assistance regarding any public adjuster services related to natural disasters. Our experts will be there to meet your needs.

About Tornado Claims

Hail and wind caused by a tornado can damage any home and property in just an instant. Tornado claims will help you cover any damage that it has done, without causing you stress. Some details may vary depending on where you live, the cause of the damage, and the amount of the total damages.

Most insurance policies have personal property coverage that will replace the damaged things inside the house, while dwelling coverage helps to rebuild and repair the house from tornados. Always read policies to understand the coverage of the insurance.

You have the right to select how you would like to be reimbursed by your insurance. One way is to use the actual cash value coverage, which pays back the insured amount. Another way is replacement cost coverage, which helps you reimburse or replace the same things that were damaged.

Not all of them. Consumers can choose if they will apply a policy deductible. Tornado deductibles can be paid by dwelling coverage or in the form of a cash amount. Some states do not let insurers have deductibles.

You can always contact your public adjuster for an update. We will always be available when you have questions about the process. You can let us know you want a regular update or any other details related to the claim.

Public adjusters will get a small percentage from your claim. The pay is usually done after your insurance claim is paid out to you. Search online to find one near you. You can also contact us for a straightforward process of your insurance claim

He or she can handle any professional claims such as earthquake claims, tornado claims, and other insurance claims. They are known as claims adjusters that must be licensed and support policyholders in negotiating or appraising an insurance claim.

A public adjuster can be any association, company, person, partnership, or corporation that does the job of submitting a property or insurance claim to an insurance company on behalf of the claimant or insured person.

The two major types of adjusters are public and insurance adjusters. A public adjuster’s job is on behalf of the claimant and they work for you, while the insurance adjuster works for the insurance company.

The payment for the damages that the government can assist you with is not enough to cover everything. Having a coverage claim will help with that. Besides, you will never stress because they will conduct the meetings and arrangements with the insurance company on your behalf.

The charges consist of their service, fees governed by the state, and fees for essential documents. Lawfully, the public adjuster should not receive or charge any payment before your arrangements.

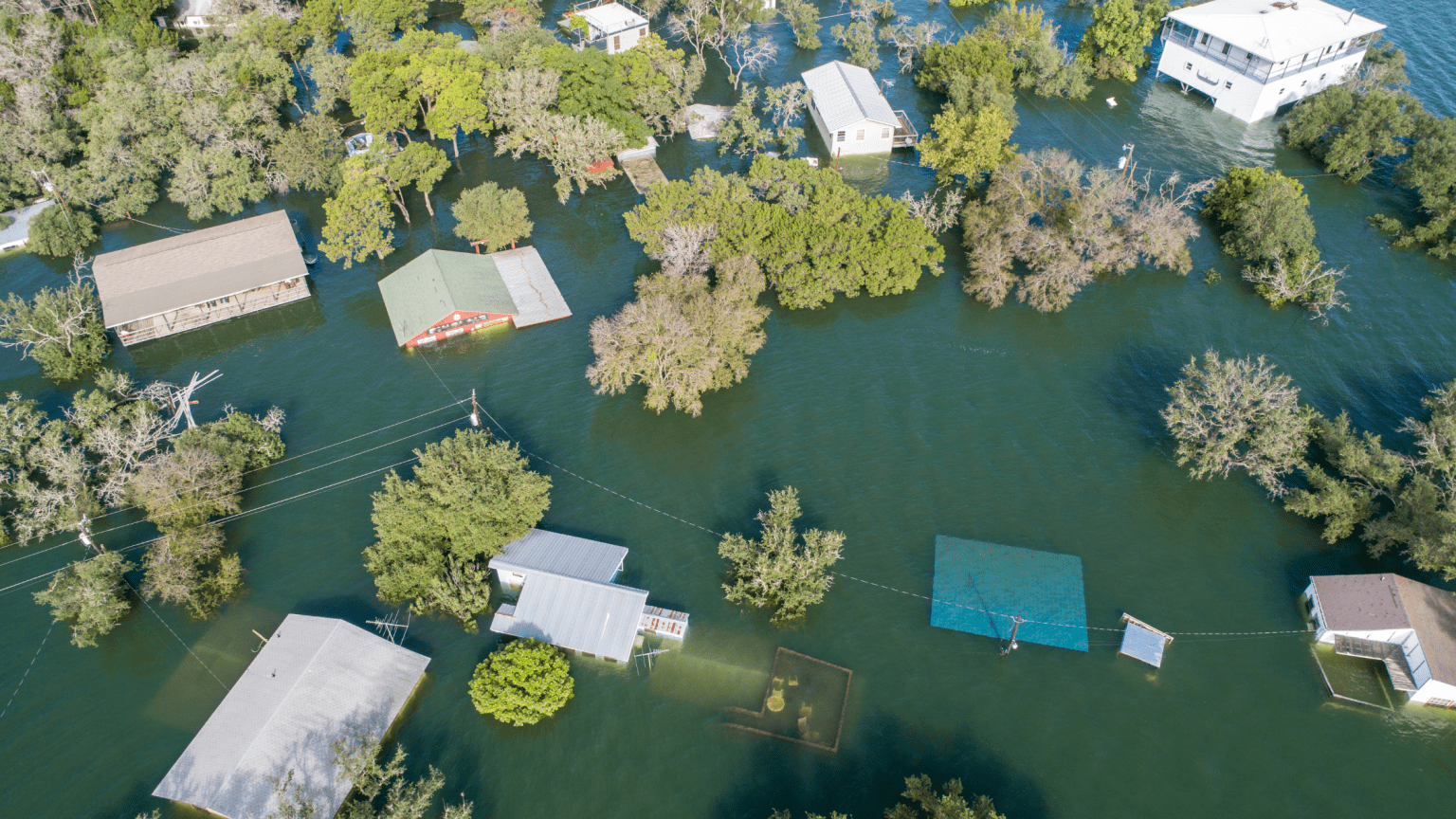

About Water Damage vs Flood Damage Claims

Flood damage refers to the rapid accumulation of water from a source or mudflow created by flooding. Water damage, on the other hand, can involve the following: clean water from broken pipes, sprinklers or overflowing sink or toilets; greywater from chemicals; and blackwater or sewage water which may harbor toxic or contagious matter.

It is important to verify which insurance policy you have claimed to note whether it is for flood or water damage. Just being aware of the definition of each damage in your insurance policy can save you a lot of headaches in the future.

1. Broken pipes that lead to flooding, rusting, molding, or warping wood.

2. Sewer system damage.

3. Roof leakage.

4. Malfunction of an appliance such as a washing machine that can flood your laundry area.

5. Overflow of water from accidents and clogging of the drain in the bathtub or the toilet.

6. Fire sprinklers that have leaked or were accidentally triggered.

7. Humidity which lead to basement or bathroom mold or destruction of property.

Your insurance policy can range from home repair to personal property replacement, which includes clothing, appliances, and furniture. It should be your top priority to learn what your insurance covers.

As mentioned above, the two damages have different meanings and hence separate insurance coverage is needed. It’s best to review your insurance to be sure of which one is covered in your insurance.

1. Prevent further water damage from the source.

2. Take photos or videos of the water damage.

3. Contact us at National Damage Appraisers to get the direction you need to succeed with your claim.

4. Verify the existence of your water damage insurance.

5. Request a certified copy of your flood policy from your insurance agent or broker.

6. Receive an estimation of property damage or the cost of restoration.

7. File a Notice of Loss through the Nation Flood Insurance Program (NFIP).

8. Within 60 days, file a Proof of Loss with us

Handling negotiations with insurance agencies can be a complicated business. There are lots of scenarios where your claim can be underpaid or estimated below its actual value. Having a public adjuster assist can help you resolve claims faster and always in your best interest.

A public adjuster can properly assess your property damage for you in a way that is closest to the actual value. Public adjusters are experienced in filing water and flood claims. We are well-equipped to help you with filing claims and guiding you through the steps of what to include or exclude in your claims to get the most benefit.

Public adjusters can maximize the benefits you receive for your water damage claims. Our company has a lot of experience and a clear understanding of insurance policies. We are well-equipped to assess your properties and negotiate better claims.

Our team is composed of board-certified damage appraiser experts at 111 Construction Services LLC. We use our years of experience to make sure our customers receive the maximum benefit for their claims, along with various technologies, to assess damages properly.

When it comes to your water damage claims, we have the best professionals who can help you with your dilemma. Give us a call today and we’ll do the work for you!

Usually, for heavily damaged houses, it takes a minimum of eighteen months and a maximum of twenty-four months to rebuild and repair the home.

About Wind and Storm Claims

Insurance companies are created to avoid financial burdens created by natural disasters by answering and supporting the people affected by these. In the insurance industry, it helps save individuals by helping them recover the things that they have lost due to the storm.

If you have seen that there are damages to your property, it is advised to contact your local insurance company to investigate damages and possible damages further. By calling a roofing contractor, roof repairs would also be inspected and would not be overlooked.

Instead of checking the roof for damages by yourself, call a professional who could help fix the problem. Observe your home’s attic for a leakage of water or any stains on the wall or ceiling because most water stains are a sign that you need to repair or change your roof.

Inspect for damaged areas on your floor due to the storm and check your chimney’s surroundings for missing and lost shingles or pieces of metal. Also, look in the corners of the walls where they meet the roof for further assessment and double-check the exhaust pipes as well. Seek professional help to not only clear out the tree that landed on top of the roof, but also for you to know how much damage your home has encountered.

Get in touch with your insurance company immediately when you see there are damaged areas in your home so that they can assess it as early as possible. However, in any natural calamities that occur, help may not be immediately available so you must have patience.

Policies differ from one state to another, but most of the time, from the date the natural calamity occurred, you have about a year to file your claim. It is best to call a qualified contractor to do the roofing and thorough inspection as soon as the storm has ended.

It isn’t needed or required to have a roofing contractor in filing an insurance claim, but it is better to have one with you so that things are not overlooked. It would also help you to know and check the damages in your home with an unbiased appraisal.

Most of the time, nothing seems to be wrong by the appearance of your roof after a storm – if you are untrained. You still need to contact a qualified contractor to do the roofing of your house to check for possible damages that occurred during the storm.

Before hiring a professional roofing contractor, you must look into their company and make sure it is located within your vicinity.

After a storm, it is highly encouraged to contact your insurance agent immediately for further inspection. Vacate your area for safety purposes and avoid nailing a temporary tarp on top of your roof because this may lead to water leakage in your home. Make sure that your insurance agent presents you your statement of loss for proof.

Be sure to document any found damages that weren’t seen by your agent because this will be charged to your insurance claim. Assure that your contractor is a professional roofing contractor and has experience working with wind and storm damages. Keep photocopies and document all of the information your insurance company sends to you.

About Winter And Flood Claims

Damages caused by floods need precise documentation and files that include indirect and direct costs. Indirect costs are incurred or acquired for the period consisting of property values’ reduction, business losses in connection to homeowner’s income, and trauma due to the flood. On the other side, direct costs are immediately affected by the flood leading to loss. A flood knocking down a deck behind your house would be seen as direct damage.

Prioritize having a copy of your policy’s insurance that holds auto, business, umbrella, tenant’s insurance, etc. and also consists of endorsements, pages of declaration, and any relevant filings or paperwork. Documenting or photographing the affected areas, destroyed or not, must be recorded for further evidence.

Even if the president does or does not announce an emergency, homeowners may still file their winter and flood claims. If your house has insurance for flood damage, then the tenant is already covered regardless of the president’s support.

Before filing for a claim, you must contact your insurer and notify them that you have encountered damages in your home due to the flood. By informing your insurer, an adjuster will reach out to you in a few days. If there is no response from the adjuster, you may call the company or agent assigned for the insurance case.

Photographs that are captured may be used in making your claims but be sure to keep photocopies for back-up and personal filing. You may also create a list of lost or damaged personal belongings attached to the receipts from when they were bought and the value they held. Homeowners must again settle a proof of loss in which a legal statement of the price of damaged items is presented to support your winter and flood claims.

Frequently, insurance companies will point to the homeowner’s statute of limitations when it comes to filing winter and flood claims. Although states vary from one to another, a proof of loss account or statement should be filed within sixty days before the winter and flood with the insurance company’s aid.

Once the homeowner exceeds the statute of limitations, the insurance agents and the company, in general, have no accountability to reimburse the tenant for the damaged areas of the property.

Though you may file for a lawsuit for damaged property after the deadline up to three years, most courts would close the case. However, there are a few exceptions, but these cases are unlikely to occur; such as if the homeowner was underaged and could not make legal decisions. The tenant may file for a winter and flood claim for the damaged property if the legal guardians have failed to file a claim.

After a winter or flood disaster, it is best to get in touch with your insurance company to guide you on what to do. By contacting your insurance agent, it will also help the homeowner for safety purposes.

The most dangerous floods are flash floods because they are a combination of both speed and power. When heavy rainfall goes beyond the ground’s ability for absorption, it leads to flash floods. It is highly encouraged to call a professional to seek assistance after a flood to inspect for possible damages and prevent it from happening again.

About Residential Claims

If your house was destroyed or damaged by a natural disaster, the replacement of items, repairs of damaged areas and loss may be a burden. If your house is insured, then the policy of insurance can help you get back on your feet.

For homeowners experiencing this for the first time, you may be new to the policy’s system in general, but there are rights that you have because of the rules and laws. Through these laws, you can settle and restore via the benefits that you paid for under your policy. People often ask questions about how to settle everything in the right way. Listed below are frequently asked questions regarding residential claims.

The main person to be in touch with is your claims is your adjuster because they will handle all forms of damage and loss for the homeowner. As a broker, they are there to guide you and reach out to your adjuster if you have trouble contacting them.

Usually, for heavily damaged houses, it takes a minimum of eighteen months and a maximum of twenty-four months to rebuild and repair the home.

As a homeowner, it is your job to clear out debris in your lot. However, policies vary from one another. The total cost of the work is covered if your coverage says so. If the house was destroyed or damaged by a natural calamity, you must contact your local government officers and check whether they have a program for removing debris.

The cost may vary depending on the materials used, the degree of the damage within the area, and the initial installation’s quality. When getting your residential claim, prioritize picking a professional contractor with experience for your house’s value to be preserved. It would be best if you considered hiring reliable and trustworthy contractors; this way, the longevity of the needed repairs is of the highest quality.

There is no required number, but it is highly encouraged to get at least three estimates or inspections from professional contractors that have a specialization in repairing and fixing damages from storms for residential claims.

If your home was destroyed or damaged by a storm, you only have a limited amount of time to file for your residential claims. Considering the short time given, your residential claim being approved, and the schedule for repairs, you should take action immediately because it is essential.

Residential claims are said to finish one year before the date of loss. It is best to contact your local government officials to inquire about their programs or ask your adjuster to help you with this. By law, your adjuster should provide you with a proof of loss form because it is a formal document which states all the details related to your loss. Usually, your adjuster would hand this out once you get your residential claims.

The homeowners’ responsibility is to produce and provide information that is not only complete but also a detailed truth to the extent of the individual’s loss and hand it over to your residential claims adjuster. Also, it is very important to take proper steps to avoid future damages or loss on the homeowner’s property, or it may be a factor that could change the policy of the residential claims to cover the loss of property.

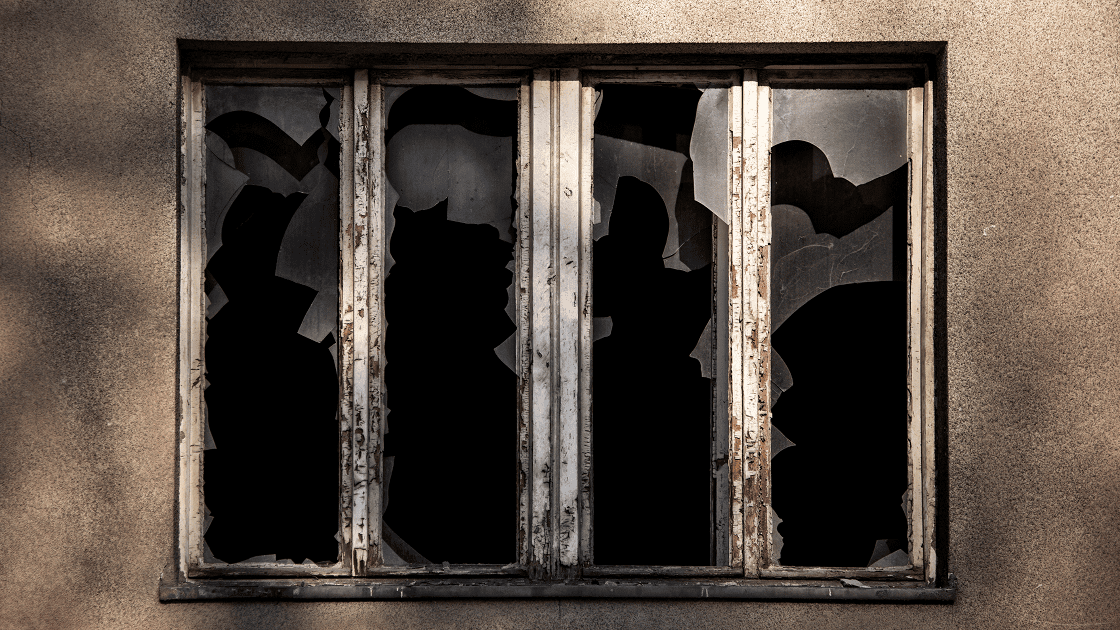

About Theft and Vandalism Claims

One of the major problems regarding theft and vandalism claims is if the homeowner owns the items. It is convenient to monitor your belongings properly for documentation. However, if this hasn’t been done prior to the incident, photographs or the individual’s credit card statements could also be enough evidence to prove ownership of the damaged or missing belongings.

On the other hand, most losses and damages rooted in vandalism are usually covered by the homeowner’s insurance policies and the standardized commercial property. However, there are exceptions to this, such as the property’s vacancy from thirty to sixty days. It is highly encouraged for homeowners to look at endorsements for the vacancy to their own properties’ insurance policy.

Before filing a case, contact your local police department if you have encountered any theft or vandalism to your property, or witnessed a vandal or theft incident. Be sure to have complete information before making a claim such as the police number report, contact details of your insurance company or agent and possible witnesses, along with the incident’s exact location.

Use security system alarms and deadbolts in your home. When installing motion detecting or exterior lights, keep them out of reach. Make sure that there are specific locks on the windows of your house.

Documents such as receipts, photographs and videos, credit card statements, and endorsements for insurance policies are already evidence of ownership. By filing these for documentation, it supports your theft and vandalism claim while it is being processed.

If a home has been unused or is vacant for sixty consecutive days, then the losses from theft and vandalism are not included. On the other hand, vandalism that has been done by the insured is not covered, which means the insured is not entitled to claim.

You may file your claim online or by calling. Typically, when contacting your insurance company, the agent will list down the full details and statements of what happened prior to the incident. The agent will review your coverage of insurance and will aid you in the next process.

Insurance agents usually guide you in which files and documents are sent and other paperwork sent to you. After, they will give you your claim number. Most calls tend to last around thirty minutes.

A homeowner who is a victim of vandalism and theft can experience extreme emotional breakdowns and trauma. If you see that your area has been vandalized or property has been stolen, get in touch with your nearest local police department as soon as possible. In such cases, by the calls made, they are mainly backed up with the details and information said at the time of the incident.

It is the responsibility of a policyholder to ensure that the local authorities’ information is accurate and honest related to the theft or vandalism incident. If you later find out that there is added information to the original report, contact your local authorities and your insurance company immediately to be notified of the new data and findings.

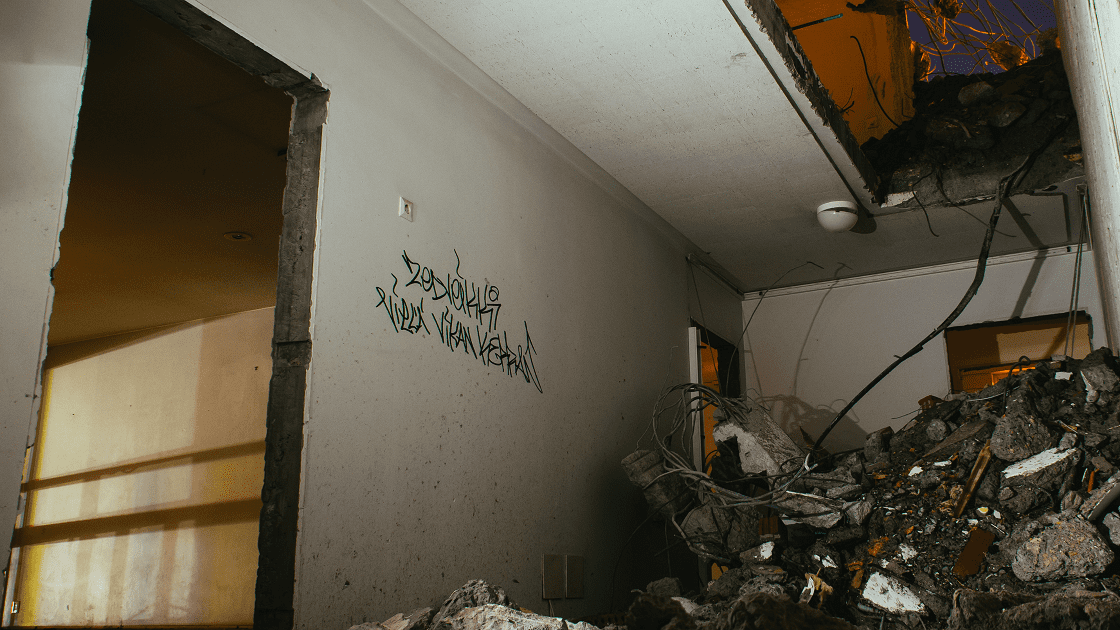

About Building Collapse Claims

Collapsed buildings can be caused by many factors such as: ice and snow on the roof, shockwaves rooted in explosions, soil subsidence, earth movements, structural compromise, improper construction, gas leaks, and more.

Although property insurance policies usually cover building collapse claims, they do not apply to all aspects. Nowadays, insurance companies diminish or restrict collapse coverage by changing or redefining the word “collapse”, limiting exposure.

As soon as possible, you must appeal for an accredited copy of your insurance policy and then determine how the term “collapse” is defined in your policy. Once you have a building collapse claim, wait before starting any restoration or rebuilding until your construction has a sturdy claim.

Determine and complete detailed information about your building’s incident, and secure that your insurance agent or adjuster puts it in hard copy like writing. Choose or decide if the collapse is only partially damaged and check if the building has unseen damage within the structured building.

Request an appeal that the insurance company you are affiliated with provides you with documentation in writing related to the building collapse insurance coverage or, if it is applicable, a written denial of the claim.

Most insurance claims are difficult to handle when you are not a professional insurance adjuster. It is best advised to consult and contact a public adjuster who has experience if one or more of the following problems have applied:

– Your insurance claim has been denied or has been delayed for more than a month

– You have been required to submit a proof of loss form

– You have received or accepted a letter of reservation of rights from your insurance company

If your insurance company has refused your collapse coverage or your damage was not entirely focused on, thoroughly viewed or damaged areas have been undervalued, get in touch with an individual you trust who has background experience in being a public insurance adjuster as soon as possible.

You should be attentive to the options and rights you have as a policyholder, even if it means that your insurance company may deny your claim. Insurance adjusters are experienced in handling situations and will help you find solutions for the claim that you deserve in handling your settlements.

Although the damages to buildings caused by collapses are not cheap, most insurance companies deny coverage. Thus, it is best to contact an experienced public adjuster who you can trust for any consultations about claims involving a structural collapse of any kind.

Altogether, building collapse claims are challenging to handle on your own and waiting for the buildings to collapse is extremely dangerous. It is best to consult with a professional public adjuster to help you take the next step after the incident.

About Ice and Snow Claims

Poor weather conditions involving ice and snow can sometimes ruin the most wonderful time of the year. Extreme winter weather is known to be a culprit in considerable damage to properties, homes and cars, which can lead to potential accidents.

Preventive actions are taken to avoid most damages, but severe weather conditions are usually unforgiving. Problems can arise, such as ice dams, causing roof leaks and car accidents due to icy roads. These disasters can affect people physically and emotionally.

The process of acquiring ice and snow claims can be daunting for some; however, pertinent information and preparation can help in making the undertaking smoother. Here, common questions are answered in regards to how to claim appropriate compensation.

Getting started

Before getting into organizing your insurance claims, familiarize yourself with everything involved in ice and snow claims.

○ Ice and snow claims comprise individuals involved in accidents or property damage due to snow or ice. These victims may be drivers or passengers, homeowners, or pedestrians..

○ Individuals involved directly or indirectly and who are not liable for the accident are qualified to make ice or snow claims..

○ The initiative to take action relies on the individuals involved. Homeowners or people involved in accidents are expected to act responsibly to handle their concerns and acquire the appropriate compensation.

○ This is also the purpose of the guide here: to empower individuals to be aware of their claims. We’re here to help you achieve the proper compensation for each claim.

○ Gathering necessary information is essential to reinforce your ice or snow compensation claim. Here are some of the following data you’ll need:

■ Photos – These can be taken by the people involved or witnesses during the time of the incident. It includes the situation, injuries sustained, and damaged property to provide visual proof.

■ Expenses – Proof of all payments or costs as a direct outcome of the situation or injuries are to be kept.

■ Medical Reports – Assessments from medical professionals from any harm done are to be documented and reported. This is essential in calculating the appropriate compensation.

■ Witnesses – Gather statements from witnesses or bystanders during the incident to strengthen your claim.

■ Third-Party Information – Details regarding other people involved, such as names, contact details, car details and registration number are to be taken to help trace people responsible.

Undergoing the process

Now that the essential information has been identified, going through the claiming process will be easier.

○ Ice and snow claims are easier to manage with the appropriate help, which is what our service prioritizes. We’re here to handle all necessary details needed and guide you throughout the entire process.

○ We answer all your concerns in the consultancy sessions and compile all the information needed to comprehend your situation thoroughly. The claiming process begins once you are satisfied and we have identified the case.

○ The most common types of snow or ice-related claims are related to vehicular accidents, bicycle or cycling accidents, pedestrian accidents, or whiplash injuries.

○ For homeowners, roof damage, ice dams, and frozen or burst pipes leading to interior water damage are commonly included in claims. House fires are also viable due to increased heating usage during the winter weather and any other property damaged as a result.

○ In the event of property damage, refrain from disposing of all losses. The damaged property is to be evaluated to identify potential replacement costs.

○ In the event of an accident, warn other drivers that an incident has occurred by turning on the hazard lights. Position the vehicle in a safe place and gather necessary evidence of the surroundings. Identify people involved or injuries sustained and seek medical help.

○ Successful claims need to establish who is liable, and all parties must provide the necessary proof. For example, property owners with damaged frozen pipes must prove the structure itself was maintained regularly. Even so, it may still result in having an unclear conclusion of who is at fault.

○ If you are hesitant about the validity of your claim, our service will assist you in the best possible way.

○ Exact compensations are hard to identify as each situation varies, but lists of average payouts can be found online. Rest assured, once the claim is made, we can help achieve the appropriate compensation for your identified concerns.

Taking action

○ Our service prioritizes our duty to our clients and puts them first. We calculate, negotiate, and resolve your insurance claims while upholding the best standard of service and empathy for your situation from start to finish. We deliver results efficiently while showing consideration for the struggle our clients go through.

○ If you have concerns regarding ice and snow incidents and would like to file a claim or have questions left unanswered, call us at 111 Construction Services LLC (877-290-2929). Our specialized team is pleased to help in all ways possible to get you started.

About General Property Damage Claims

If you are having a hard time getting the proper compensation from your insurance, the 111 Construction Services LLC are here to help you out. We are a team of public adjusters whose services have been proven and tested by many individuals who have successfully acquired their money from their insurance. After enduring a disaster where your insurance money is of utmost importance, we ensure that our clients are well-represented with their claims.

The 111 Construction Services LLC is a group of professionals who are licensed and trained in the insurance field. Should you have any questions, the following FAQs may be able to help you. If not, feel free to contact us at 877-290-2929.

A property damage claim involves a person’s possessions and the damage that has been done to them. Insurance policies that have a clause for property damages are eligible for any claims related to them. Generally, there are two types: damage to one’s land or home and damage to autos. Damage claims are made to get insurance money. They require gathering evidence and sufficient proof that the possessions have indeed been damaged. The insurance company then decides if the claims should be settled or not.

They include but are not limited to the following:

• Homeowner’s Insurance to cover physical damages to a house;

• Renter’s Insurance to cover belongings and expenses;

• Commercial Property Insurance to cover physical damages to a building’s interior and exterior, including its contents;

• Flood Insurance to cover damage to property due to flood; this is often excluded in the homeowner’s insurance policy.

Depending on your policy, it may include destruction caused by hurricanes, damage caused by debris like a fallen tree or wind, or extreme rain. It may also cover anything damaged by flooding, fire, water leakage, and any other natural disasters or accidents.

Your policy must cover your property, first and foremost. It should include any Disaster Policy, Flood Policy, and any other policy that includes accidental damages to the property.

You can contact your insurance company for this, and a representative will assess the damages for you. The representative will tell you if you have a claim or not in your insurance. To speed up the process, you can also hire a public adjuster to ensure that you have a claim.

Depending on the process, it might take up to 15 days for insurance companies to respond to your claims.

About Condominium Damages

Common damages include:

• Water leaks

• Mold

• Explosions or fire

• Broken pipes

• Burglaries

• Water heater leaks, among many others

Your condo insurance covers everything within your unit, including:

• Interior walls

• Floors

• Appliances

• Furniture

There are two types of insurance for condominium owners: the master policy and the homeowners’ policy. The owners need to make an inventory of their personal possessions before applying to determine how much coverage they need.

Owners will need to file a claim directly to their insurance provider. Documentation of evidence of the claims must be made, as well as inspections.

About Damages from Broken Pipes

Broken pipes are often caused by:

• Water pressure

• A shift in the house’s foundation

• Corrosion of pipes

• Rapid changes in temperature

The possible damages include:

• Water leaks

• Flood

• Water damage

• Frozen pipes

If you have a homeowner’s insurance policy, it may help you cover the damages caused by accidents. However, it does not compensate you for anything that is caused by poor maintenance in plumbing.

About Damages from Explosions

Explosions caused by pipes, appliances, electricity, or accidental fires at home can be considered as part of such a phenomenon.

Explosions on your property can result in:

• Injuries

• Fire

• Destruction of the property nearby, such as appliances and furniture

A fire insurance policy can help you with the damages. This covers incidents caused by:

• Fire

• Lightning

• Explosion or implosion

• Impact damages

About Damages from Hail

Hail or hailstorms are considered a natural disaster. It is a phenomenon where drops of water freeze together in the atmosphere and fall as lumps of ice.

Hail is caused by extreme thunderstorms.

Common damages include:

• Roof damages

• Window damages

• Siding damages

• Damages to air conditioning

Your homeowner’s policy insurance usually covers damages from natural disasters. Inspection and documentation, however, is required for your claims.

About Damages from Roof Leaks

The possible causes of roof leaks are:

• Broken shingles

• Punctured valleys

• Poor quality of materials

• Clogged water flow

• Poor room ventilation

• Old roofs

Roof leak damages include:

• Punctured ceilings

• Discolored walls

• Structural damage

• Damage in insulation

• Floor damage

If you have a homeowner’s policy, then you are covered. Keep in mind that poor maintenance might hinder your claims.

About Damages to a Building

If the damage is caused by the vehicle, the vehicle’s owner must cover the cost for repairs. In that case, their insurance coverage must take care of the matter. The property damage liability coverage oversees this.

Your policy must include the direct physical loss of the building or any part of it, including accidental collapse.

Homeowner’s Insurance typically does not cover mold damage. However, if there is any other policy that specifically states such, your insurance might be able to help you with the damage.

About Public Insurance Claims Adjusters or Public Adjusters

We, public adjusters (also known as public insurance claims adjusters or property damage appraisers) are experts who work on behalf of policyholders for filing and claims adjusting in the event of property damage or loss. Part of our job is to assist you in the preparation, filing, negotiation and management of your insurance claim from beginning to end.

Our team consists of adjusters, appraisers and legal professionals who are well-versed in the language and specifics of insurance policies. We will save you the time and stress involved in claiming what is due to you.

There are many reasons why you should hire a public adjuster to help you settle your claims. Some of the reasons are:

– Processing claims is a long process… and tedious, to say the least. The inventory which contains both the items you lost and presently have will be very detailed. An adjuster will aid you in identifying the pieces of evidence you need to indicate.

– We take the stress away from you because you won’t experience delays that you would typically have when you process claims on your own, since we already know the ins and outs of claims adjusting. Our public adjusters and damage appraisers can promptly provide the insurance company all of the requirements needed to process your claim. Remember, this is what we do best!

– Insurance companies acknowledge that we work on your behalf, and because we are speaking the same language, we can negotiate better.

No. We (public adjusters and damage appraisers) are hired exclusively by you, and we always work on your behalf. Adjusters provided by the insurance company are employed by them and will work on their behalf. It is a fact that public adjusters have formerly worked for insurance companies, giving them the knowledge needed in interpreting insurance policies and claim settlement processes.

The fees you pay the public adjuster will come from a small percentage from the total sum of your claim, so it varies. The state administers the amount we make. In terms of legality, we cannot charge you upfront and may only collect fees once our representation is successful.

Yes you can, but know that processing claims is very tedious work which can be very confusing and stressful at times, especially since it involves money you need in order to fix or restore your damaged property.

It is advisable to let a public adjuster do the work for you, given the years of experience we have in handling insurance claims. Parts of the processes in which we can help you with your claims are:

– Preparation of inventory, estimates and evidence of loss

– Compiling and filing needed details as required by the insurance company

– Negotiating with insurance company agents

– We will help you in preparing the estimates and evidence of loss.

– Review, evaluate and help you understand the entirety of your insurance policy

The majority of individuals and businesses are now seeking the services of an adjuster for a fairer and prompter settlement.

Yes, by all means. Through the efficiency of our public adjusters and damage appraisers, we evaluate and review the coverage of your policy. We do our best to search for evidence one may fail to notice which can make a big difference to your sum amount.

Our public adjusters are very thorough when it comes to claims adjusting and we work in your best interest by increasing your settlement. People who previously worked with public adjusters will seek the expertise they provide when getting a claim.

Yes! Since our adjusters are experts on the field, we know the exact requirements the policyholder must provide the insurance company. Through this, we can settle your loss quicker.

Certainly not. Most insurance companies will find it beneficial to work with public adjusters in settling the claim due to its complicated nature.

Through the service of an adjuster, the paperwork required by the insurance company will be prepared more efficiently, thus saving time in settling your claims.

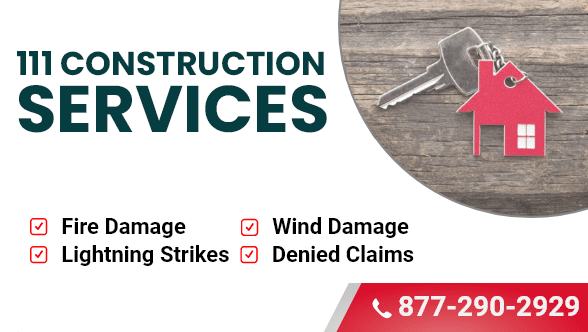

We can assist you in claims for damages caused by floods, windstorms, hail, smoke, fire, explosions, wind, hurricanes and other property losses like business income interruption, improvements and more. Our public adjusters will handle all the filing and handling of this so you won’t have to add more stress on top of the loss caused by such damages.

Our team will prepare a scope of loss that has all the specifics of the state of your property before the loss. Together with the policyholder’s help in providing the needed details of what the property was like before the damage (both exterior and interior), the public adjuster will conduct the inventory, get all relevant appraisals and ensure all the arrangements are covered by your policy. There are tools we use to aid us in estimating the loss. Our estimates can significantly benefit you in your claims adjustment.

The pay you will get from the insurance company will depend on the type of insurance policy you paid for. Some insurance policies do pay a higher amount than what is indicated on your declaration. For you to be able to reach a substantial settlement, our public adjuster will work to know how much you are entitled to and the specifics of the coverage stipulated on your insurance policy. All we can promise is to work hard for what you deserve.

Totally – all the more reason you will need to hire a public adjuster’s service is when claims are denied. There are many reasons why your claim may not push through; some of which can range from not understanding the clauses of your policy, mistakes in filing, not giving enough details about the damage, and so much more.

What we can do is help you review the policy, reopen the case and fight for the settlement due to you. Our team of professionals who know all about the verbiage of insurance will represent you in the process of your appeal.

In the event of a loss, the first thing to do is report it to your insurance agent or company as imposed by your policy’s terms. You must have a copy of your insurance policy from your insurance agent. Then, get public adjusting services by calling us to represent you and conduct the process of getting your fair settlement

Call 111 Construction Services LLC at 877-290-2929. Our team will give you an evaluation and policy review free of charge. With the help of our public adjusters and damage appraisers, you don’t need to endure the stress of claiming your loss. All you have to do is give us a call and we will gladly assist you.

In Case We Did Not Answer All Your Questions, Here’s Your Chance

Simply enter your question or questions in the form below, enter your email address, and hit Submit. That’s it. We’ll get back to you asap.