Has Your Home Burned Down? The Last Thing you Should Worry About is Filing a Property Damage Claim

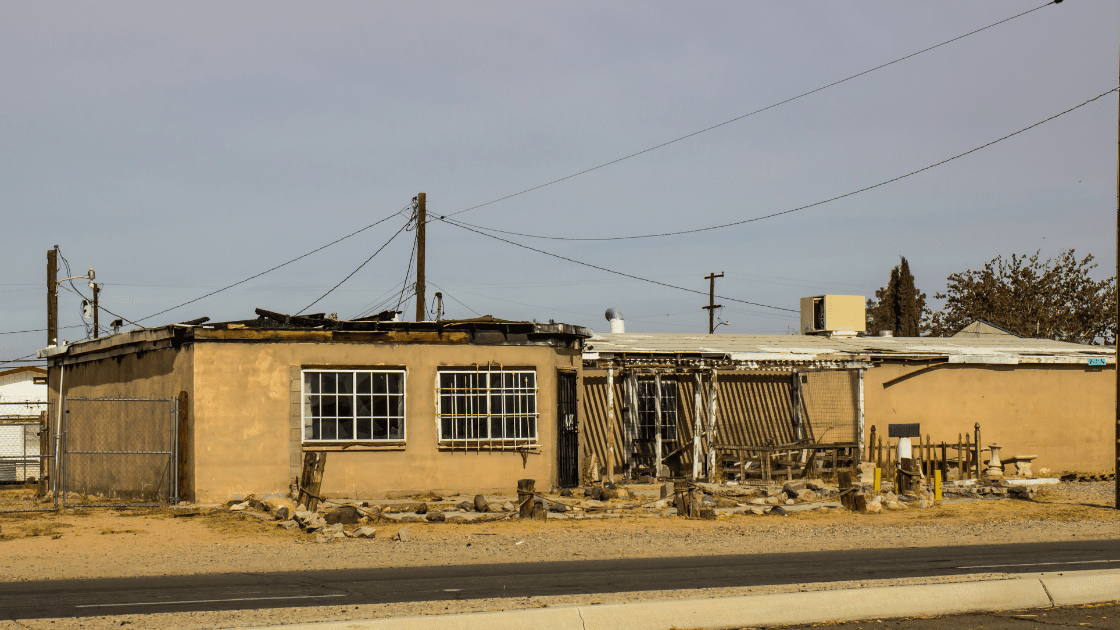

Buying your own house is a dream for a lot of people, and a substantial amount of money is spent to fulfill that dream. You spend hours and hours beautifying your abode and making it a reflection of your personality and taste. You exhaust all means to ensure that your family will live as comfortably and as safely as possible at all times.

Accidents happen and oftentimes, they are quite devastating. Tragedies not only break people’s hearts, but more than that, they require a lot of money to bring back the glory of the home you share with your loved ones.

One of the most — if not the most — awful accidents that can happen to your precious abode is fire. A lot of times, a fire can destroy an entire structure in a matter of minutes, leaving you with nothing but painful memories of the tragedy.

If your property has been damaged or completely destroyed by a fire, you can file a homeowner’s insurance claim.

Filing a property damage claim after a fire

The very first thing you need to do besides securing your family after a fire accident in your home is to get in touch with a public insurance claims adjuster or a certified property damage appraiser. Instead of reaching out to your insurer who will assign an adjuster for you, a more logical thing would be hiring a public insurance adjuster which would be more beneficial for you.

A certified property damage appraiser works independently and on your behalf. This means that they work with your best interest at heart as opposed to a private adjuster who works for your insurer.

Here’s what you need to know about filing a property damage claim with the help of a public insurance claims adjuster.

- Document all losses.

Once the fire department has ruled that the fire has been completely put out, take pictures of the damages and make a list of everything that has been destroyed, including the roof, windows, plumbing and heating systems, walls, and framing. It would also help to include the costs for each item on your list. You can also attach receipts for proof.

Even if the incident may seem to have only caused minimal damage, you still need to inspect and assess it thoroughly. The extreme heat may have some impact on some parts of your home that may not be obvious. You will need to consult structural engineers or contractors to evaluate the hidden damage.

- Keep your home secured.

Insurance companies require policyholders to take reasonable steps to ensure that no further harm occurs or in legalese, to mitigate damages. These include preventing a flare-up, boarding it up, and checking for new problems that may occur due to the incident.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

- Secure an advance.

Depending on the extent of the damage, you and your family may be forced to evacuate your abode, which means that you will need cash to buy basic necessities and food. You can request to your insurer to issue an advance payment against your claim. Depending on your insurance coverage, you may only have “actual cash value” for personal items that you lost. Be sure to be reasonable and to keep all your receipts.

- Verify your insurance coverage.

In addition to covering the damages caused by the fire and smoke, standard insurance policies will also cover damages that may have been caused by firefighters while they were putting out the fire. If your home wasn’t completely damaged, you may still be able to file a claim for additional living expenses in the event that you were mandated to leave your house for security reasons.

- Discuss limits or exclusions in your policy.

Some insurers will try to wiggle their way out and give you a compensation amount that is too low. Have them explain everything in writing to understand how they got to that estimate. Also, they should include the reasons why certain items are not covered and what the limits are.

A public insurance claims adjuster can help you determine whether the compensation you are getting is too low or not. This is the difference between hiring a certified property damage appraiser and relying on the insurance company’s adjuster.

- Make copies of every document you submit.

Your insurer will most likely require you to submit various kinds of paperwork, including financial records and personal information. Make photocopies of all the documents you will submit.

Similarly, you should also keep a backup or documentation of all your communication with your adjuster. Take note of what you discussed, as well as their demeanor. Everything they tell you to do should also be documented. This will be helpful in case you will want to change adjusters during the claims process.

FINAL WORDS

Insurance firms will try to close fire insurance claims in the shortest amount of time. Don’t be confused. The longer your claim is open, the better chances you will have of making sure that you’ve covered everything that you need to cover, especially when it can affect the amount of compensation you can claim.